Trump’s 2025 Statement: Context and Content

In mid-May 2025, former U.S. President Donald Trump – during a business forum in Doha – revealed that he personally pressed Apple CEO Tim Cook to halt the expansion of iPhone production in India and to move those operations to the United States. Trump’s remarks came against the backdrop of escalating U.S.-China trade tensions. At the time, his administration had threatened punitive tariffs exceeding 100% on Chinese goods, raising alarm for companies like Apple that rely heavily on China. Apple had been fast-tracking a “China+1” strategy – pivoting some production to India – to hedge against supply disruptions and potential cost increases from those tariffs.

Trump, however, took issue with Apple’s chosen alternative. “I said to [Tim Cook], Tim, you’re my friend… But now I hear you’re building all over India. I don’t want you building in India,” Trump recounted, underscoring that Apple should build in the U.S. instead. He noted that India has been a high-tariff market – “one of the highest tariff nations in the world,” as he described – but claimed India had offered the U.S. a trade deal with “basically no tariff” on American goods. Despite acknowledging that India is “doing very well” economically, Trump bluntly stated, “We’re not interested in you building in India… We want you to build here [in the U.S.]. India can take care of themselves”.

This extraordinary public statement put Apple in a delicate position. Just weeks earlier on May 2, 2025, Tim Cook had told investors that a majority of iPhones sold in the U.S. that quarter would have India as their country of origin – a clear sign of Apple’s accelerating shift of production to Indian factories. Reports even suggested Apple aimed to eventually assemble all iPhones for the U.S. market in India to sidestep Chinese tariffs and geopolitical risk. Trump’s message essentially ran directly counter to that plan.

Apple’s Investment and Manufacturing Footprint in India

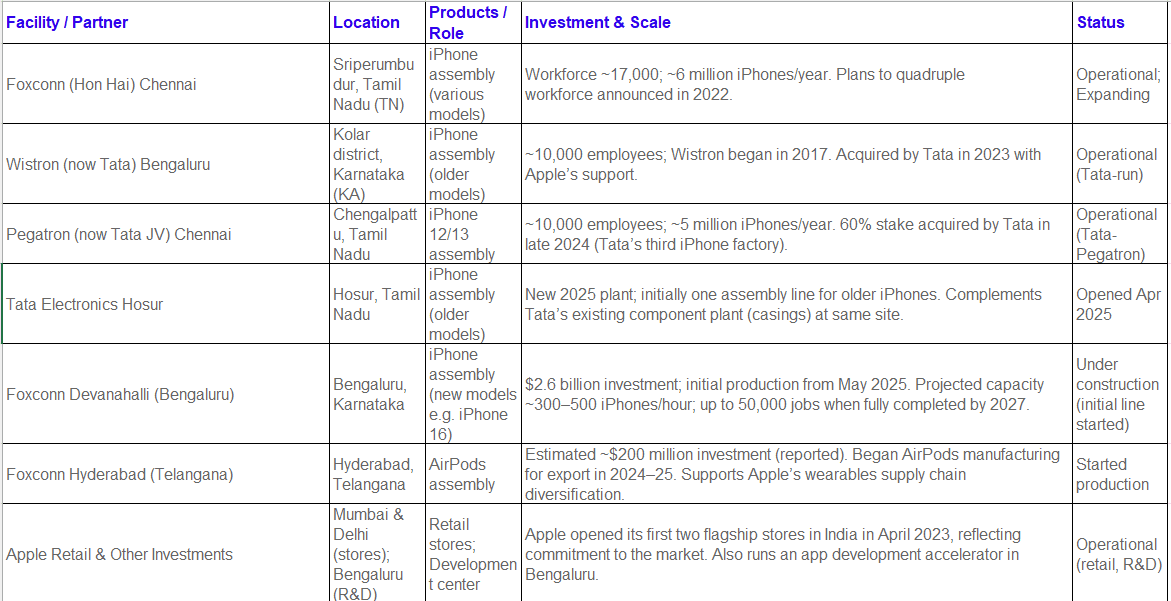

Apple’s presence in India has grown from a minimal base in 2017 to a sprawling network of contract manufacturers and partners by 2025. Below is an overview of major Apple-linked facilities in India – both operational and in the pipeline – as of 2025:

Table:Apple’s Manufacturing & Investment Presence in India (as of 2025). Apple’s three main contract manufacturers – Foxconn, Pegatron, and Wistron (Tata) – each established iPhone assembly operations in India, with new facilities coming online in 2024–25. India has become a production base not just for local sales but for exporting iPhones globally, including to the U.S. market.

Apple’s India strategy has been driven by both market potential and supply chain diversification. India’s massive population represents a significant growth market for Apple, and local manufacturing also helps Apple meet India’s import tariff rules and qualify for government incentives (like the Production-Linked Incentive (PLI) scheme). By 2023, Apple’s India-manufactured iPhones were estimated at 5–7% of its total output. The Indian government optimistically claimed Apple was targeting up to 25% of its production in India in the coming years. Indeed, analysts projected India would supply 20–25% of all iPhones by 2024 (up from ~12–14% in 2023), thanks to the rapid scaling of factories.

Leading into 2025, Apple and its partners announced a flurry of new investments. Foxconn’s $2.6B Bangalore iPhone campus and Tata’s expanding role (taking over plants from Wistron and Pegatron) illustrate Apple’s intent to make India a major manufacturing hub. Apple reportedly hit $22 billion in production value in India in FY2025 alone, and in March 2025 Apple shipped a record $2 billion worth of iPhones from India to the U.S. in anticipation of possible tariffs. All this underscores that Apple was doubling down on India – until Trump’s intervention introduced new uncertainty.

Potential Impact on Apple’s India Plans After Trump’s Call

Trump’s admonition raised questions about whether Apple would scale back or delay its India expansion to placate U.S. political concerns. Early signals suggest Apple is being cautious but not reversing course:

Temporary Review of U.S.-Bound Production: Following Trump’s comments and an unexpected U.S.-China “tariff truce”, Apple began reassessing the speed of its shift of U.S.-destined iPhone production to India. According to Indian media sources, Apple put its dedicated “India for U.S.” strategy “under review” pending clarity on geopolitical and tariff conditions. In other words, Apple may temporarily pause the plan to move all U.S. iPhone assembly to India while the tariff situation evolves. An industry source noted, “We will take a breather before embarking on any mega production expansion plans in India for U.S. supply”.

Reassurance of Ongoing Investment: At the same time, Apple has privately assured the Indian government that its broader investment plans remain intact. Indian officials reached out to Apple soon after Trump’s remarks, and Apple executives reiterated that India will continue to be a “major manufacturing base” for Apple’s products. “There is no change in Apple’s investment plans in India,” government sources told the press, emphasizing that Apple’s commitments via Foxconn, Tata, and others will proceed despite the political noise.

Diversification vs. Localization Dilemma: Apple now faces a strategic balancing act. On one hand, accelerating Indian production was a response to tariff threats on China; with tariffs on Chinese imports temporarily eased (or excluded for electronics), Apple might feel less urgency to relocate production. On the other hand, Trump’s clear preference for U.S.-based manufacturing puts Apple under political pressure. Apple may choose to slow-roll further capacity increases in India intended for U.S. consumption, to avoid provoking policy retaliation (for instance, Trump could consider tariffs on imports from India if displeased – a scenario Apple wants to avoid). However, Apple is unlikely to abandon its multi-year India investments outright, given the substantial sunk costs and long-term supply chain goals.

In short, Apple appears to be treading carefully: continuing its India expansion (especially for global and Indian-market production) but quietly delaying any dramatic shifts of U.S. supply until there’s more certainty on U.S. trade policy. Tim Cook’s promise that India would be central to Apple’s production remains, but timelines may extend. Any scaling back or delay in Apple’s India strategy could carry significant economic implications for India.

Economic Implications for India if Apple Scales Back Investment

If Apple were to halt or significantly scale back its investments in India, the ripple effects on India’s economy – particularly in the electronics manufacturing sector – would be substantial. Key areas of impact include:

Job Creation and Employment: Apple’s contract manufacturers have become large employers in India. For example, Foxconn’s upcoming Bengaluru iPhone campus alone is expected to create around 50,000 jobs at full capacity by 2027. Tata’s takeover of Wistron and Pegatron plants preserved or expanded jobs (Pegatron’s Chennai factory has ~10,000 workers). In total, Apple’s India supply chain (Foxconn, Tata, Pegatron, etc.) likely accounts for tens of thousands of direct factory jobs, plus additional jobs in logistics, construction, and support services. A pullback by Apple would jeopardize these future job opportunities. For instance, plans to ramp up from ~17,000 to much higher numbers at Foxconn’s Chennai site or to hire tens of thousands in new facilities might be stalled. The loss isn’t just the raw number of jobs, but also the quality – these manufacturing roles provide stable incomes (often for semi-skilled women workers, as at Foxconn Sriperumbudur) and help upskill the workforce in high-tech assembly. Reduced Apple engagement could slow the growth of electronics-sector employment in India.

Manufacturing Ecosystem and Supply Chain Growth: Apple’s investments serve as an anchor for developing a broader electronics supply chain in India. When Apple builds iPhones locally, a network of component suppliers – for camera modules, chips, circuit boards, casings, etc. – tends to grow around the assembly plants. Indeed, Apple’s presence has already drawn some supplier activity (for instance, Foxconn’s new $433 million semiconductor component plant was approved in 2025 to support local production). If Apple scales back, fewer global suppliers will invest in India, stunting the country’s ambition to become an electronics manufacturing hub. Local firms that might have benefitted from partnerships or knowledge transfer could miss out. Over time, this could keep India stuck importing key components instead of making them domestically, undermining the “Make in India” and Atmanirbhar Bharat (self-reliant India) initiatives. In contrast, Apple continuing on course was expected to raise India’s share of iPhone production to 20–25% and stimulate a self-sustaining ecosystem. Losing that momentum could cede ground to other countries in the race to host Apple’s supply chain.

Tax Revenues and Trade Balance: In the short run, if Apple cuts back Indian production, the Indian government might actually collect more in import duties (since more iPhones would be imported rather than assembled duty-free). However, this is a double-edged sword. High import tariffs on finished phones (around 20%) mean costlier iPhones for Indian consumers, potentially dampening sales and GST/VAT revenues from those sales. More importantly, local manufacturing leads to corporate income taxes and payroll taxes that far outweigh import duties in the long term. Foxconn, Pegatron/Tata and others would eventually pay taxes on profits from India operations (many received tax breaks initially, but not indefinitely), and their thousands of employees pay income tax and spend wages in the local economy. Those future tax contributions would be lost or delayed if the factories don’t ramp up. Additionally, Apple’s India factories have rapidly become major exporters – Apple was on track to export $8–10 billion+ of iPhones from India in 2025, up from $5 billion the previous year, according to industry estimates. Exports boost India’s trade balance and bring in foreign exchange. If Apple halts investment, the expected export surge might stall, thereby worsening the trade deficit (India would import more smartphones and export fewer). Overall, while India might gain some tariff revenue from increased imports, it would lose far more in broader economic value from curtailed local production.

Tariffs and Market Prices: Trump’s statement highlighted India’s high tariffs and implied a deal for zero tariffs, but currently India uses import duties as a lever to encourage local production. If Apple doesn’t manufacture certain models in India, those models face steep import duties, making them significantly pricier in India. This can suppress consumer demand or push Apple to absorb costs, affecting its India business viability. Conversely, Apple’s local manufacturing has allowed it to launch new iPhone models in India at prices closer to global levels (avoiding the duty markup). Should Apple scale back, Indian consumers could see higher prices or delayed availability for Apple products. Furthermore, part of Apple’s rationale to assemble in India was to eventually mitigate tariffs elsewhere – for instance, avoiding U.S. tariffs on China-made devices by exporting from India. If that plan is scrapped, Apple could be more exposed to tariffs in Western markets as well, which indirectly affects India: a tariff on China-origin iPhones would have made India a more attractive source, potentially increasing Indian export production. Without it, India loses that advantage.

Local Skill Development and Technology Transfer: Major projects like Apple’s bring advanced manufacturing techniques, worker training, and stringent quality controls – effectively transferring know-how to India’s industrial workforce. Over time this can elevate the technological capability of India’s manufacturing sector (for example, Indian engineers and managers learning Apple’s processes). If Apple’s expansion stops, this skill and technology infusion slows down. India would miss the opportunity to become proficient in producing cutting-edge electronics at scale, a capability that could spill over to other industries (e.g., automotive electronics or telecom equipment). There’s also an opportunity cost in terms of global credibility – Apple’s success in India would signal to other high-tech firms that India is a viable production base. A reversal might make other companies hesitant, thinking if Apple couldn’t fully commit, perhaps the environment isn’t ready.

In summary, Apple scaling back would mean fewer jobs, less technology investment, lower export growth, and a setback to India’s manufacturing ambitions. The government would lose a marquee success story for its economic policies. It could also be politically sensitive domestically – Apple’s growing presence has been touted as a win for India’s attractiveness; any withdrawal might be viewed as a policy failure or could discourage other multinationals.

Disruption to Apple’s Global Supply Chain & China Diversification

For Apple, Trump’s directive complicates a carefully laid global operations strategy. Apple has been trying to diversify its supply chain away from China, which as of 2022 still produced the vast majority of iPhones (over 200 million units a year). India was emerging as the most significant alternative production base, alongside smaller moves into Vietnam and other countries. A sharp pivot away from India (to satisfy U.S. political demands) could disrupt Apple’s global manufacturing in several ways:

Continued Overdependence on China: Pulling back from India would likely keep Apple heavily reliant on its Chinese manufacturing hubs. This runs counter to risk mitigation efforts. Apple’s dependence on China has been highlighted by events like China’s COVID-19 lockdowns (which “badly disrupted” supply chains in 2020–21) and by geopolitical risks (e.g. tensions over Taiwan). Apple’s internal goal reportedly was to shift up to 50% of iPhone production out of China in the coming years. Without India absorbing a large share of that production, this goal becomes far more difficult. Apple would remain exposed to a single point of failure – any manufacturing halt in China (whether due to pandemic, trade war escalation, or even conflict) could leave Apple unable to meet global demand. In essence, sidelining India keeps Apple “all eggs in one basket” when it comes to its most critical product supply line.

Supply Chain Reorientation Challenges: If not India, where else? Apple’s alternatives for large-scale production are limited. Vietnam has gained some of Apple’s business (AirPods, iPads and components are assembled there), but Vietnam’s population and workforce are a fraction of India’s. It cannot single-handedly accommodate tens of millions of iPhones per year. Mexico or other Western hemisphere sites have been floated for final assembly, but they currently lack the established electronics clusters and would still rely on shipping components from Asia. U.S. manufacturing of iPhones, which Trump advocates, faces steep challenges: higher labor costs, the need to import nearly all components (since the component ecosystem is Asia-centric), and factory automation that is not yet advanced enough to offset cost differences. Apple did pledge to invest in the U.S. – e.g., a new $20 billion expansion of chip manufacturing and a server assembly facility in Texas/Houston as part of a $500 billion U.S. investment plan – but producing hundreds of millions of iPhones domestically would require a complete supply chain rebuild. In the short term, there is no ready substitute if India is deemphasized; Apple would be stuck leaning on China and a handful of smaller sites, potentially leading to bottlenecks and higher costs.

Higher Costs and Prices: One driving force for Apple’s diversification was cost and tariff avoidance. Manufacturing in India comes with higher unit costs than China (wages in India’s tech factories are rising, and productivity is still catching up), but those costs could be justified if Chinese tariffs made China more expensive. If Apple must instead localize to the U.S., costs would be even higher than India’s. American assembly workers earn multiples of their Indian counterparts, and Apple would likely have to invest billions in automation to even attempt U.S. iPhone production. The net effect could be a significant increase in production costs per unit, potentially forcing Apple to either compress its profit margins or raise iPhone prices globally. Apple’s supply chain mastery has always been about finding the most efficient locations for each part of production; a politically driven supply chain (favoring U.S. assembly) runs against that grain and could erode Apple’s cost competitiveness. In a worst-case scenario, if tariffs hit imports from China and India, Apple might have to pass on a large cost increase to consumers – risking demand, especially in price-sensitive markets.

Timing and Innovation Pipeline: Apple refreshes its key products (like iPhones) on a strict annual cycle. Major shifts in supply chain require long lead times (factory construction, worker training, trial production runs). Apple had already begun that process in India – e.g. training thousands of workers to assemble the latest iPhone models and working with local authorities to improve infrastructure. If that momentum is lost, Apple could face delays in product rollout if it needs to reallocate production hurriedly in the future. For example, if a new iPhone model was supposed to have, say, 20% of units made in India, but that plan changes last-minute due to political pressure, Apple might scramble to ramp up additional lines in China or elsewhere, which could risk product shortages or quality control issues. A less diversified supply chain is also less resilient; Apple’s operations team would have fewer fallback options if one country’s production has an issue (whether political or natural disaster, etc.).

Ultimately, Apple’s efforts to reduce dependency on China and de-risk its supply chain could be significantly set back. While the company will not abandon diversification entirely (Vietnam, for instance, will still produce certain products), losing India as a key pillar means Apple’s supply chain remains heavily Asia-centric, with geopolitical risk largely unabated. This could worry Apple’s investors and partners – in fact, Apple’s stock had already been under pressure in 2025 amidst these tariff and relocation concerns (shares were down ~15% year-to-date by mid-May 2025), reflecting how critical supply chain decisions are to the company’s outlook.

India’s Possible Countermeasures and Mitigation Strategies

The Indian government is keenly aware of what’s at stake and would likely take steps to mitigate the impact if Apple’s engagement slows. Some possible countermeasures India could implement include:

Enhanced Economic Incentives: India could sweeten the deal further for Apple and its suppliers to continue investing. This might involve expanding the Production-Linked Incentive (PLI) scheme – for example, increasing the subsidy for higher volumes of phones produced locally or extending the duration of incentives to give Apple more financial reasons to stick with India. The government could also offer tax breaks, import duty waivers on certain components, or faster depreciation benefits for capital equipment to reduce Apple’s cost of manufacturing in India. Essentially, India may try to offset any cost differential between making iPhones in India vs. in the US. State governments (like Karnataka and Tamil Nadu) have already given generous packages (for instance, Karnataka approved roughly ₹6,970 crore (~$840 million) in incentives for Foxconn’s new plant) – these could be topped up or new packages offered for future projects (such as semiconductor assembly, display fabrication, etc.). By making India’s proposition more financially attractive, the government can bolster Apple’s resolve to stay the course.

Trade and Tariff Diplomacy: Given Trump’s focus on tariffs, India might engage in diplomatic negotiations to diffuse that issue. One approach could be to offer some concession on import tariffs for U.S. goods, addressing Trump’s complaint about market access. If India indeed floated a “zero tariff” deal as Trump claimed, India could pursue a limited trade agreement with the U.S. that lowers tariffs on select American exports in exchange for recognition of Indian manufacturing. Additionally, India could lobby for Apple’s India-made devices to be exempt from any future U.S. device tariffs. By highlighting that Apple’s India production uses some U.S.-made components and creates value for both countries (e.g., Apple’s Houston facility making server hardware, design work done in California, etc.), India can make the case that Apple’s India expansion is not against U.S. interests. High-level dialogues (perhaps at a U.S.-India trade forum) could be initiated to ensure that policies like PLI (which Trump might view as subsidizing Apple abroad) are understood in context and to prevent any tariff retaliation against India-made electronics.

Policy Reforms to Boost Competitiveness: India can double down on improving the overall business environment for manufacturing. This includes infrastructure upgrades (better power supply, logistics connectivity to ports/airports, etc. in manufacturing corridors), and labor reforms to allow more flexible scaling of workforce with proper worker protections. Some reforms are already in motion, but the government could accelerate efforts to cut red tape – e.g., single-window clearances for all permissions needed by Apple suppliers, more robust IP protection and contract enforcement to reassure foreign investors. By lowering the operational frictions and costs in India, these measures would increase the country’s attractiveness regardless of political pressure. The goal would be to make India’s advantage so compelling (in terms of efficiency and market access) that Apple’s cost-benefit analysis still favors growth here. Speed and predictability in policy will be key – if Apple sees that India can swiftly adapt and support their needs (like swiftly allocating land for expansion or resolving customs bottlenecks for parts import), it will be more confident continuing to invest.

Diversification of Tech Partnerships: In case Apple does scale back, India will seek to fill the gap by courting other global tech giants and expanding existing partnerships:

Other Device Manufacturers: India has already attracted Samsung (which manufactures a large volume of smartphones locally) and is encouraging Google to assemble Pixel phones in India. These efforts can be ramped up, with incentives for other consumer electronics firms (e.g., Dell/HP for laptops, Cisco for networking gear, etc.) to set up plants. Recently, Google began making Pixel phones in India and could scale that with government support. Similarly, domestic brands (like Lava, Micromax) can be supported under PLI to expand and maybe capture some export markets, partially compensating for any lost Apple volume.

Deeper Supply Chain Integration: India can focus on attracting the component ecosystem – chip packaging and testing (OSAT) units, display module assembly, etc. Even if final assembly of iPhones faces headwinds, getting key component suppliers (perhaps ones serving multiple clients, not just Apple) to locate in India will strengthen the electronics industry. For example, India might renew talks with semiconductor consortiums or display manufacturers (like Samsung Display or LG for an OLED plant, or TSMC/Intel for chip fabs, though very ambitious) offering subsidy packages that have recently been enhanced.

Leverage Tata and Indian Firms: The Tata Group’s deepening role as an Apple supplier shows Indian firms can climb the value chain. The government could incentivize more such joint ventures or acquisitions – for instance, enabling Tata or others to partner with firms like Foxconn on non-Apple projects (such as electric vehicle electronics, which Foxconn has interest in) or to supply other brands. If Apple’s direct involvement wanes, India can still utilize the know-how gained by Tata, Foxconn, etc. to serve other clients. In essence, diversify the customer base of India’s electronics manufacturing beyond Apple, so the sector isn’t overly dependent on one company’s strategy. This might involve courting companies like Xiaomi, Oppo, and other smartphone makers to use India as an export base (though geopolitical issues with Chinese firms exist), or aiming for production of other high-demand electronics (like telecom gear for 5G, IoT devices, etc., possibly with European or American firms).

Emerging Technologies: India could also position itself in emerging tech manufacturing – for example, encouraging Apple to manufacture its upcoming AR/VR devices or Apple Watch in India, or if Apple is reluctant, woo competitors’ projects (Meta’s VR devices, etc.). Another area is electric vehicles and batteries – leveraging companies like Foxconn (which has EV ambitions) to invest in EV component plants in India. By broadening the scope of tech manufacturing beyond just smartphones, India can reduce the impact if any one product line (iPhones) slows down.

Strengthening Bilateral Ties and Communication: Lastly, India can use diplomatic channels to ensure continuous communication with Apple’s leadership and the U.S. administration. When Trump’s comments arose, Indian officials promptly engaged Apple executives and received assurances. Going forward, maintaining a close dialogue will help preempt issues. For example, if Apple feels caught between U.S. and India expectations, a three-way understanding (U.S. officials, Indian officials, Apple) could be sought whereby Apple’s India operations are seen as a net positive for all. India might highlight that Apple’s investments are also creating jobs in the U.S. (through ancillary needs like machinery, software services, etc.) and that a strong Apple is good for both economies. Proactive diplomacy could mitigate the chances of sudden policy moves blindsiding Apple’s plans. In essence, India would aim to align its interests with Apple’s and the U.S.’s, so that Apple doesn’t have to choose one over the other.

In conclusion, India has both the motivation and the tools to respond to any slowdown by Apple. By making production in India as attractive and low-risk as possible, offering diplomatic solutions on trade issues, and broadening the tech manufacturing landscape, India can cushion itself against the worst-case scenario of Apple significantly curtailing its presence. Indeed, early indications show India “downplayed” Trump’s critique and remains confident that Apple will continue seeing India as indispensable. The coming months will test that resolve.

Conclusion

Donald Trump’s May 2025 exhortation for Apple to “build in America, not India” highlighted the geopolitical cross-pressures on Apple’s supply chain choices. The statement’s immediate context – looming U.S.-China tariffs and Apple’s shifting of iPhone production to India – underscores how deeply intertwined trade policy and corporate strategy have become. For Apple, India represents both an emerging market and a manufacturing safe haven to reduce reliance on China. For India, Apple’s investment is a cornerstone of its economic development in electronics.

If Apple were to heed Trump’s call in any significant way, it would reverberate through India’s economy: thousands of jobs and billions in planned investment would hang in the balance, and India’s dreams of high-tech manufacturing prominence would face a setback. Apple itself would risk entrenching its dependency on China and raising its cost base, at odds with its long-term interests.

However, thus far Apple appears committed to not letting short-term political pressure derail its India strategy – a strategy born out of hard lessons from supply chain disruptions and the need for diversification. India, for its part, is poised to do what it takes to keep Apple and other tech manufacturers on side, from offering incentives to negotiating at the highest levels of government.

The economic implications for India – in jobs, tax revenues, supply chain growth, and technological advancement – are simply too significant to forfeit. And for Apple’s global strategy, the diversification to India plays a critical role in maintaining resilience against geopolitical shocks. Therefore, barring a dramatic shift, one can expect Apple to continue (perhaps more quietly) expanding in India, even as it increases U.S. investments to mollify political concerns. India will likely respond by making itself even more hospitable to Apple and peers. In the delicate global dance of supply chains and politics, Apple and India have strong mutual interests – something even a Trump-sized intervention may slow but not easily stop.

Sources:

Reuters – New Delhi (Apr & Nov 2025): Apple accelerating India production amid U.S.-China tariffs; Foxconn/Tata investment details.

Investopedia News (May 15, 2025): Coverage of Trump’s remarks to Tim Cook in Doha.

Press Trust of India via Outlook Business (May 15, 2025): Indian officials’ response and Trump quotes on India being high-tariff.

Times of India (May 16, 2025): Apple reviewing scale-up for U.S. market after tariff truce; Cook’s pledge that majority of U.S. iPhones to be India-made.

Business Today (May 15, 2025): Apple’s reaffirmation of India plans; production value and export surge.

India Today (Apr 30, 2025): Summary of new Tata and Foxconn plants and capacities (iPhone 16 production, 50k jobs); Mark Gurman on Apple moving all U.S. iPhone assembly to India.

TIME Magazine (Oct 2023): Insight into Foxconn’s Chennai factory workforce and Apple’s China diversification rationale.

Reuters – New Delhi (Jan 2023): Indian minister Piyush Goyal on Apple targeting 25% production from India.

Business Standard/Reuters (Nov 2024): Tata’s acquisition of Pegatron India plant and Apple’s ~20% global supply from India.